Understanding What is Liability Insurance? A Complete Guide 2024

Introduction to Liability Insurance:

What is Liability Insurance and what does it serves as a protective shield against claims arising from injuries or damages caused to others. It encompasses various scenarios where individuals or businesses may be held legally responsible for the harm inflicted upon third parties or their properties.

Key Components of Liability Insurance

- Coverage and Protection: Liability insurance offers financial protection by covering legal costs and payouts associated with the insured party’s legal liability.

- Exclusions: While liability insurance provides broad coverage, it typically excludes intentional damage and contractual liabilities from its scope.

How Liability Insurance Works

Liability insurance operates primarily as third-party insurance, focusing on compensating injured parties rather than the policyholders themselves. It becomes indispensable for individuals or businesses liable for injuries or property damage caused unintentionally.

Examples of Liability Insurance in Practice

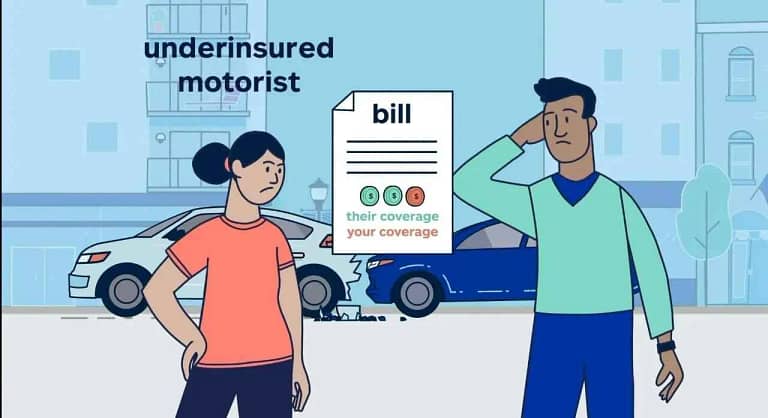

- Automotive Liability: State regulations often mandate liability insurance for vehicle owners to cover damages and injuries resulting from accidents.

- Product Liability: Manufacturers safeguard themselves with product liability insurance to address claims arising from faulty products causing harm to consumers.

- Professional Liability: Professionals such as doctors and lawyers secure errors and omissions (E&O) insurance to mitigate risks associated with negligent professional services.

Special Considerations in Liability Insurance

- Personal Liability Insurance: High-net-worth individuals may opt for personal liability insurance to protect substantial assets beyond conventional coverage limits.

- Global Market Trends: The liability insurance market demonstrates significant growth potential, with forecasts projecting substantial market expansion by 2031.

Types of Liability Insurance

- Employer’s Liability: Mandatory for employers, providing coverage for workplace injuries or fatalities.

- Product Liability: Essential for businesses manufacturing goods, offering protection against lawsuits due to product defects.

- Umbrella Liability: Provides additional coverage beyond primary liability policies, safeguarding against catastrophic losses.

Distinguishing Personal and Business Liability Insurance

While personal liability insurance caters to individuals facing claims related to personal actions or property, business liability insurance shields companies from legal liabilities stemming from business operations.

Understanding Umbrella Insurance

Umbrella insurance supplements existing coverage limits for homeowners, auto, or watercraft insurance, offering affordable additional liability protection.

Exploring Backdated Liability Coverage

Backdated liability insurance offers coverage for claims arising before the policy’s inception, albeit being relatively uncommon and subject to specific conditions.

Navigating Commercial General Liability (CGL) Insurance

CGL insurance extends comprehensive coverage for businesses against property damage, bodily injury, and legal claims arising from various liabilities.

Determining Adequate Liability Insurance Coverage

The selection of coverage limits should align with the policyholder’s net worth, ensuring adequate protection against potential claims and lawsuits.

Considerations for Minimum Requirements and Restrictions

State regulations and individual circumstances dictate minimum liability insurance requirements, necessitating careful evaluation to comply with legal mandates and mitigate risks effectively.

Conclusion

Liability insurance stands as a cornerstone of risk management, providing indispensable protection against unforeseen liabilities and legal challenges. By understanding its nuances and leveraging appropriate coverage options, individuals and businesses can safeguard their financial interests and navigate complex legal landscapes with confidence.

FAQs About What is Liability Insurance?

How can I obtain liability insurance?

Liability insurance can be purchased from insurance companies, brokers, or agents specializing in liability coverage. It’s essential to compare quotes, review policy terms, and choose a reputable insurer that meets your specific needs.

What does liability insurance cover?

Liability insurance typically covers legal costs, settlements, and judgments associated with bodily injury or property damage claims brought against the insured party. However, coverage may vary depending on the type of liability insurance policy and its specific terms and conditions.

Who needs liability insurance?

Anyone who faces the risk of being held legally responsible for injuries or damages to others should consider liability insurance. This includes individuals, business owners, professionals, and property owners.

What are the different types of liability insurance?

Some common types of liability insurance include:General liability insurance

Product liability insurance

Professional liability insurance (e.g., errors and omissions insurance)

Employer’s liability insurance

Umbrella liability insurance

What are the exclusions and limitations of liability insurance?

Liability insurance policies typically exclude coverage for intentional acts, criminal activities, and certain types of liabilities specified in the policy. It’s essential to review the policy terms carefully to understand the exclusions and limitations.

What is liability insurance, and why is it important?

Liability insurance provides protection against claims for injuries or damages caused to third parties. It’s essential because it helps individuals and businesses mitigate financial risks associated with legal liabilities.