What is Collision Insurance?: What it Covers and Why It’s Important?

Introduction

In the unpredictable world of driving, accidents can happen at any time, leaving you with unexpected repair bills and financial stress. That’s where collision insurance comes into play. This article will delve into what collision insurance is, what it covers, and why it’s essential for every driver to consider.

What is Collision Insurance?

Collision insurance acts as a protective shield, offering financial assistance for repairing or replacing your vehicle in the event of damage resulting from collisions with other vehicles or objects like fences or trees. Although not universally mandated by law, it’s frequently a prerequisite by lenders for individuals financing or leasing their vehicles.

What Does Collision Insurance Cover?

Collision insurance steps in to help with repair costs in various scenarios:

- Collision with another vehicle.

- Collision with an object like a fence or tree.

- Single-car accidents involving rolling or falling over.

- However, it’s essential to note what collision insurance doesn’t cover, such as damage unrelated to driving, damage to another person’s vehicle, or medical bills.

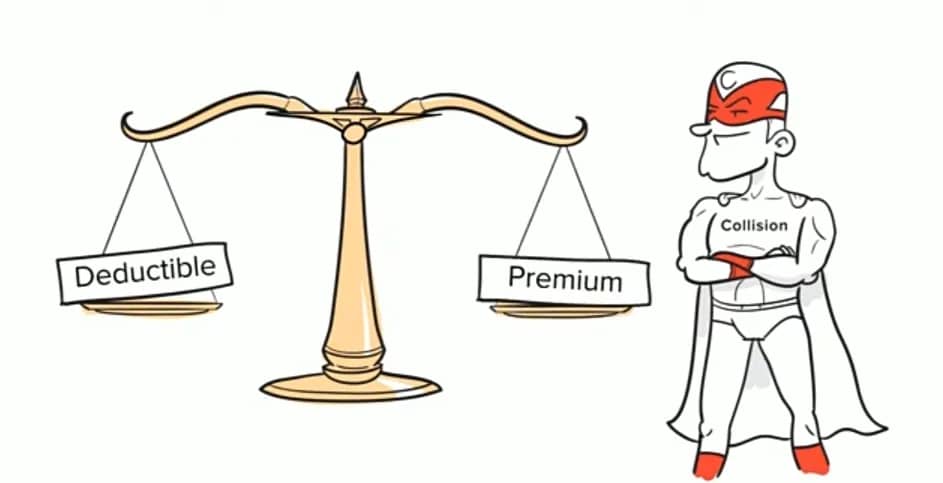

Collision Coverage Deductibles and Limits

Understanding deductibles and limits is crucial when purchasing collision coverage. Deductibles represent the amount you pay out of pocket before your coverage kicks in. You can choose your deductible amount, usually ranging from $0 to $1,000, depending on your insurer. Additionally, collision coverage has a limit, typically the actual cash value of your vehicle.

Why Buy Collision Coverage?

If you’re financing or leasing your vehicle, collision coverage is often mandatory. However, even if you own your car outright, it’s worth considering collision insurance. It provides financial protection in case you can’t afford to repair or replace your vehicle after an accident, offering peace of mind on the road.

Collision Insurance vs. Comprehensive Insurance

While collision insurance covers accidents involving other vehicles or objects, comprehensive insurance extends protection to events out of your control, such as theft, vandalism, or natural disasters. Both types of coverage complement each other to provide comprehensive protection for your vehicle.

Do You Need Collision Insurance?

While collision insurance isn’t legally required for all drivers, its benefits outweigh the costs, especially if you can’t afford to repair or replace your vehicle after an accident. Whether mandated by lenders or chosen voluntarily, collision insurance safeguards your financial interests on the road.

Conclusion

Collision insurance serves as a crucial component of any auto insurance policy, offering financial protection in the event of accidents. By understanding what collision insurance covers and why it’s essential, drivers can make informed decisions to safeguard their vehicles and financial well-being on the road. Whether mandated by lenders or chosen voluntarily, collision coverage provides peace of mind and security in uncertain driving situations.

FAQs on What is Collision Insurance?

Is collision insurance required by law?

No, collision insurance is not required by law in most states. However, if you’re financing or leasing your vehicle, your lender or leasing company may require you to have collision coverage.

What does collision insurance cover?

Collision insurance covers damage to your vehicle resulting from collisions with other vehicles or objects, as well as single-car accidents like rolling or falling over. It typically helps pay for repairs or replacement of your vehicle, minus your deductible.

Does collision insurance cover damage to another person’s car?

No, collision insurance only covers damage to your vehicle. Liability insurance typically covers damage to another person’s car if you’re at fault in an accident.

Does collision insurance cover medical bills?

No, collision insurance does not cover medical bills. Medical expenses are typically covered by personal injury protection (PIP) or medical payments coverage, depending on your insurance policy.

How does the collision insurance deductible work?

Your collision insurance deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. You can choose your deductible amount when you purchase collision coverage, and higher deductibles usually result in lower premiums.