Beyond Finance Accelerated Graduation Loan Program

Education is a crucial investment for individuals seeking to advance their careers and achieve their dreams. However, the rising costs of higher education can pose significant financial challenges for many students.

To address this issue, Beyond Finance Accelerated Graduation Loan Program offers an innovative solution through its Accelerated Graduation Loan Program. This article aims to explore the features, benefits, and application process of this program, allowing students to make informed decisions about financing their education.

Introduction

As the cost of education continues to increase, students often face the dilemma of choosing between pursuing their desired career path and managing their financial responsibilities. Traditional student loans can burden graduates with long-term debt, making it challenging to start their professional lives on solid footing. Beyond Finance’s Accelerated Graduation Loan Program aims to alleviate this burden by providing an alternative funding option tailored specifically for students.

Understanding the Need for Accelerated Graduation Loan Programs

- Before diving into the details of Beyond Finance’s program, it is important to understand why accelerated graduation loan programs are gaining popularity. These programs offer a unique opportunity for students to accelerate their education, enabling them to complete their studies faster and enter the workforce sooner.

- By opting for an accelerated graduation loan program, Beyond Finance Accelerated Graduation Loan Program students can save time and money. It allows them to avoid the extra costs associated with prolonged education, such as tuition fees, accommodation, and living expenses. Additionally, students can start earning a stable income earlier, gaining a competitive edge in the job market.

Exploring the Features and Benefits of Beyond Finance’s Accelerated Graduation Loan Program

Beyond Finance’s Accelerated Graduation Loan Program provides scholars with several features and benefits that set it piecemeal from traditional pupil loans. Understanding these advantages can help scholars make an informed decision about their backing options.

Streamlined operation Process

One of the crucial benefits of Beyond Finance’s program is the streamlined operation process. Applying for pupil loans can frequently be complex and time-consuming, creating fresh stress for scholars. still, Beyond Finance has simplified the process to ensure a flawless experience for aspirants.

Flexible Prepayment Options

Inflexibility is another pivotal aspect of the program. Beyond Finance understands that every pupil’s fiscal situation is unique, and thus, offers flexible repayment options. Beyond Finance Accelerated Graduation Loan Program This allows scholars to choose a prepayment plan that aligns with their financial capabilities and pretensions. Whether it’s a standard prepayment plan, income-grounded prepayment, or a customized option, Beyond Finance aims to accommodate the different requirements of scholars.

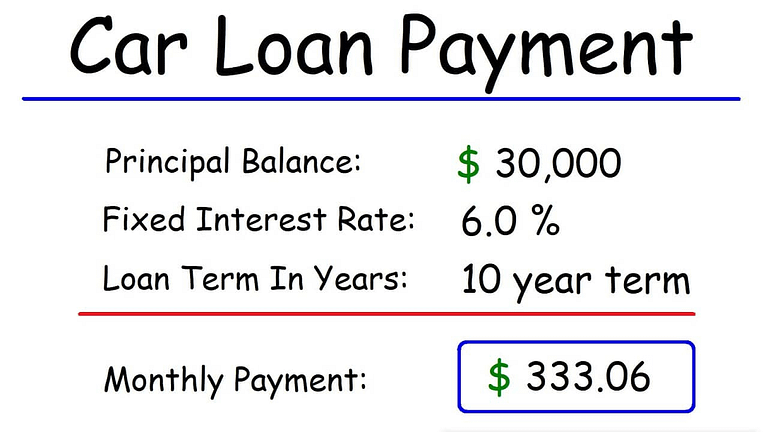

Competitive Interest Rates

Interest rates play a significant role in determining the affordability of a loan. Beyond Finance’s Accelerated Graduation Loan Program offers competitive interest rates, ensuring that students can borrow funds without incurring excessive costs. By providing favorable interest rates, Beyond Finance aims to support students in achieving their educational aspirations without burdening them with exorbitant interest payments.

How to Qualify for the Accelerated Graduation Loan Program

To take advantage of Beyond Finance’s Accelerated Graduation Loan Program, students must meet certain eligibility criteria and provide specific documents during the application process. Beyond Finance Accelerated Graduation Loan Program Understanding these requirements is essential for a successful application.

Eligibility Criteria

The eligibility criteria for the program may vary, but common requirements include:

- Enrollment in an accredited educational institution

- Pursuit of a degree or certification program

- Satisfactory academic progress

- Good credit history or a cosigner with good credit

- Citizenship or legal residency status

It is important for students to review the specific eligibility criteria provided by Beyond Finance and ensure they meet the requirements before proceeding with the application.

Required Documents

When applying for the Accelerated Graduation Loan Program, scholars will generally need to submit the following documents

- Evidence of registration in an accredited educational institution

- Particular identification documents(e.g., passport or motorist’s license)

- Evidence of income or fiscal coffers

- Academic reiterations or progress reports

- Cosigner’s information and documents (if applicable)

Students should gather these documents in advance to ensure a smooth and efficient application process.

Steps to Apply for the Program

Now that we understand the features, benefits, and eligibility requirements of Beyond Finance’s Accelerated Graduation Loan Program, Beyond Finance Accelerated Graduation Loan Program let’s explore the step-by-step process to apply for the program.

Research and Gather Information

Before applying, it is important to research and gather all the necessary information about the program. Visit Beyond Finance’s official website or contact their customer support for detailed information regarding eligibility, interest rates, repayment options, and any additional requirements.

Complete the Application Form

Once you have gathered all the required information, it’s time to complete the application form. Beyond Finance provides an online application portal for convenience. Fill out the form accurately, providing all the necessary personal and academic details.

Submit the Application and Supporting Documents

- After completing the application form, carefully review all the information provided to ensure its accuracy. Attach the required supporting documents, such as proof of enrollment, identification, and financial documents. Double-check that all documents are properly scanned or uploaded.

- Once everything is in order, Beyond Finance Accelerated Graduation Loan Program submit the application along with the supporting documents through the designated submission method provided by Beyond Finance. This may include uploading documents online or mailing physical copies, depending on the application process.

Tips for Maximizing the Benefits of the Program

While Beyond Finance’s Accelerated Graduation Loan Program provides valuable financial support, students can maximize its benefits by following these tips:

Create a Repayment Plan

Before taking on any loan, it’s pivotal to produce a comprehensive repayment plan. estimate your fiscal situation, consider your unborn income prospects, and determine a realistic timeline for loan prepayment. By having a well- allowed – out plan in place, you can effectively manage your finances and repay the loan without stress.

Use coffers and Support

Beyond Finance understands the challenges scholars may face during their educational trips. They offer coffers and support to help borrowers succeed.

Take advantage of these coffers, similar to fiscal knowledge programs, budgeting tools, and educational accouterments. Beyond Finance Accelerated Graduation Loan Program Stay informed about loan prepayment strategies, debt operation, and fiscal planning to make the utmost of the support handed by Beyond Finance.

Maintain Good Financial Habits

While in the program, it’s important to maintain good fiscal habits. This includes making timely loan payments, staying organized with your finances, and keeping track of your charges. By rehearsing responsible fiscal geste, you can make a strong credit history and ameliorate your overall fiscal well-being.

Conclusion

Beyond Finance’s Accelerated Graduation Loan Program offers a valuable solution for students seeking financial assistance to complete their education at an accelerated pace. With its streamlined application process, flexible repayment options, and competitive interest rates, the program aims to empower students to achieve their academic goals while minimizing financial burdens.

Frequently Asked Questions

How does an accelerated graduation loan program work?

An accelerated graduation loan program allows students to borrow funds specifically for the purpose of completing their education at an accelerated pace. It typically offers streamlined application processes, competitive interest rates, and flexible repayment options.

What are the advantages of choosing Beyond Finance’s program?

Beyond Finance’s Accelerated Graduation Loan Program offers a streamlined operation process, flexible prepayment options, and competitive interest rates. It provides scholars with an occasion to accelerate their education, save time and plutocrat, and enter the pool sooner.

Is the operation process complicated?

No, Beyond Finance has simplified the operation process to ensure a flawless experience for aspirants. The online operation form is easy to complete, and their client support is available to help with any questions or enterprises.

Can transnational scholars apply for the program?

Yes, transnational scholars may be eligible to apply for Beyond Finance’s Accelerated Graduation Loan Program. still, specific eligibility conditions may apply, and it’s judicious to review the program details and contact Beyond Finance directly for further information.

Can the loan be used for graduate studies?

Yes, Beyond Finance’s program can be used to finance both undergraduate and graduate studies. It provides support for scholars pursuing colorful degree programs.