Certified Debt Specialist Beyond Finance – Salary

Certified Debt Specialist: Beyond Finance

In today’s challenging economic climate, many individuals and families find themselves burdened with overwhelming debt. Certified Debt Specialist Beyond Finance The pressure of mounting financial obligations can cause stress, and anxiety, and even affect one’s quality of life. It is during these times that seeking professional assistance from a certified debt specialist can provide the necessary guidance and support to regain control over personal finances and achieve a debt-free future.

Introduction

Financial struggles can be to anyone, anyhow of income or background. unanticipated charges, medical bills, job loss, or poor fiscal operation can lead to an accumulation of debt that becomes delicate to manage. still, by engaging the services of a Pukka debt specialist, individuals can admit expert advice acclimatized to their specific fiscal situation.

What is a Certified Debt Specialist?

A certified debt specialist is a professional who possesses in-depth knowledge and expertise in the field of personal finance and debt management. These specialists undergo rigorous training and earn certifications that validate their proficiency in providing effective solutions for debt-related issues. By working with a certified debt specialist, individuals can benefit from their comprehensive understanding of various debt relief options and strategies.

Benefits of Working with a Certified Debt Specialist

Expertise and Knowledge

Certified debt specialists have a thorough understanding of debt management principles and best practices. They stay updated with the latest trends in the financial industry and possess the knowledge necessary to navigate complex debt scenarios. This expertise allows them to provide accurate advice and recommend suitable debt management solutions.

Personalized Debt Management Strategies

Each person’s financial situation is unique, and a certified debt specialist recognizes this. They take the time to assess the individual’s income, expenses, debts, Certified Debt Specialist Beyond Finance and financial goals to create a personalized debt management strategy. By tailoring their approach, they can address the specific needs of their clients and help them develop a realistic plan to reduce and eliminate their debts.

Access to Financial Tools and Resources

Certified debt specialists have access to a range of financial tools and resources that can aid in debt management. They can guide budgeting, saving, and improving financial literacy. Additionally, they may have connections with creditors and financial institutions, enabling them to negotiate better terms and interest rates.

The Role of a Certified Debt Specialist

Certified debt specialists play a crucial role in assisting individuals on their journey to financial freedom. Here are some key responsibilities they undertake:

Conducting Financial Assessments

One of the first ways a Pukka debt specialist takes is to conduct a comprehensive fiscal assessment. They estimate the existent’s income, charges, means, and debts to gain a holistic understanding of their fiscal situation. This assessment helps them identify areas of enhancement and formulate an effective debt operation plan.

Developing Debt Repayment Plans

Based on the financial assessment, certified debt specialists develop customized debt repayment plans for their clients. These plans take into account the individual’s income, existing debts, and financial goals. By prioritizing debts and allocating available funds, the specialist creates a structured approach to paying off debts efficiently.

Negotiating with Creditors

pukka debt specialists have experience in negotiating with creditors on behalf of their guests. They work to secure favorable terms, similar to reduced interest rates, extended prepayment ages, or indeed debt agreements. Through these accommodations, the specialist aims to palliate the fiscal burden and produce further manageable prepayment options.

Providing Financial Education and Support

In addition to assisting with debt management, certified debt specialists offer valuable financial education and support. They educate clients on budgeting, saving, Certified Debt Specialist Beyond Finance and responsible financial practices. Empowering individuals with financial knowledge enables them to make informed decisions and maintain long-term financial stability.

How to Become a Certified Debt Specialist

Becoming a certified debt specialist requires a combination of education, professional certifications, and practical experience. Here are the typical steps to enter this rewarding field:

Educational Requirements

Most certified debt specialists possess a bachelor’s degree in finance, economics, or a related field. This educational foundation provides a solid understanding of financial principles and prepares individuals for more advanced debt management concepts.

Professional Certified Debt Specialist Beyond Finance

To enhance their credibility and expertise, aspiring debt specialists pursue professional certifications. These certifications, such as the Certified Debt Specialist (CDS) designation, validate their knowledge and demonstrate their commitment to professional development.

Experience and Skill Development

While formal education and instruments are important, practical experience is inversely precious. Aspiring debt specialists frequently gain experience through externships, entry-position positions in finance, or levy work with non-profit associations concentrated on fiscal knowledge and debt operation.

Chancing a Pukka Debt Specialist

When searching for a Pukka debt specialist, it’s essential to find an estimable professional who can meet your specific requirements. Then are some ways to find the right specialist

Referrals and Recommendations

Seek recommendations from musketeers, family, Certified Debt Specialist Beyond Finance or associates who have preliminarily worked with a Pukka debt specialist. particular referrals frequently give precious perceptivity and firsthand gests to help you make an informed decision.

Online Directories and Search Engines

Utilize online directories and search engines to find certified debt specialists in your area. These platforms often provide detailed profiles, reviews, and contact information, allowing you to assess their qualifications and reputation.

Also More Info:

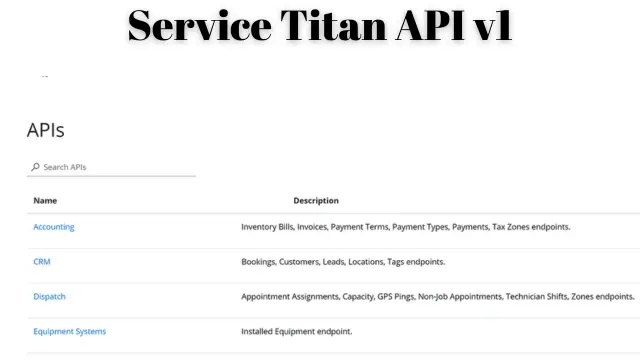

1- Service Titan Payments Gateway

2- Service Titan API v1

3- Beyond Finance Crunchbase Reviews

4- Beyond Finance Client Success Representative Salary

5- Beyond Finance Employee Reviews About Salary

6- Beyond Finance Chicago IL

7- Verizon Finance Limit Increase

8- Beyond Finance Glassdoor

Checking Credentials and Reviews

Before engaging the services of a certified debt specialist, verify their credentials and certifications. Look for reviews or testimonials from previous clients to gain further assurance about their expertise and professionalism.

Common Misconceptions about Certified Debt Specialists

There are several misconceptions surrounding the role of certified debt specialists. It’s important to clarify these misconceptions to ensure a clear understanding of their services:

Debt Consolidation vs. Debt Settlement

Debt consolidation and debt settlement are often misunderstood. Certified debt specialists focus on debt consolidation, which involves combining multiple debts into a single payment with more favorable terms. Debt settlement, on the other hand, Certified Debt Specialist Beyond Finance involves negotiating with creditors to reduce the overall debt amount.

Credit Counseling vs. Debt Management

While credit counseling and debt management are related.

Common Misconceptions about Certified Debt Specialists

There are several misconceptions surrounding the role of certified debt specialists. It’s important to clarify these misconceptions to ensure a clear understanding of their services:

Debt Consolidation vs. Debt Settlement

Debt consolidation and debt settlement are often misunderstood. Certified debt specialists focus on debt consolidation, which involves combining multiple debts into a single payment with more favorable terms. Debt settlement, on the other hand, involves negotiating with creditors to reduce the overall debt amount.

Credit Counseling vs. Debt Management

While credit comfort and debt operation are related, they serve different purposes. Credit comforting focuses on furnishing individuals with fiscal education and guidance to manage their debts effectively. Certified Debt Specialist Beyond Finance Debt operation, on the other hand, involves working with a Pukka debt specialist to develop a structured plan for repaying debts.

Frequently Asked Questions (FAQs)

What’s the difference between a Pukka debt specialist and a credit counselor?

A Pukka debt specialist specializes in furnishing comprehensive debt operation results, including developing substantiated prepayment plans and negotiating with creditors. Credit counselors, on the other hand, concentrate more on fiscal education and guidance.

Can a certified debt specialist help me avoid bankruptcy?

Yes, a certified debt specialist can explore various debt relief options to help individuals avoid bankruptcy. They work to develop feasible repayment plans and negotiate with creditors to find alternatives to bankruptcy.

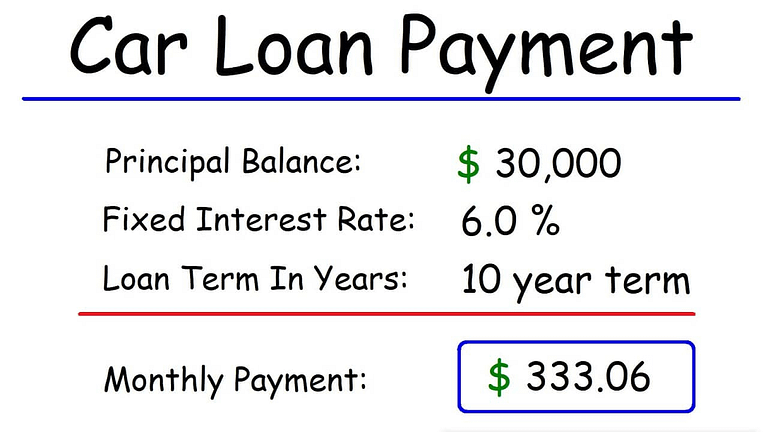

How long does it take to pay off debts with the help of a certified debt specialist?

The duration to pay off debts can vary depending on the individual’s financial situation and the amount of debt. A certified debt specialist will work closely with the client to create a realistic repayment plan and provide estimates based on their specific circumstances.

Are there any upfront fees involved when working with a certified debt specialist?

The fees charged by certified debt specialists can vary. It’s important to discuss fees and payment structures upfront to have a clear understanding of the costs involved before engaging in their services.

Will working with a certified debt specialist affect my credit score?

While working with a certified debt specialist may initially have a minor impact on your credit score, the ultimate goal is to improve your financial situation and repay debts. Over time, as debts are paid off, and responsible financial practices are implemented, your credit score can improve.

Conclusion

Seeking the assistance of a certified debt specialist can be a game-changer for individuals overwhelmed by debt. These professionals provide expertise, personalized strategies, and support to help regain control over finances and pave the way toward a debt-free future.

If you’re struggling with debt and looking for a certified debt specialist, take the first step toward financial freedom today.